MEDIA

Story

[SG Story] Covid-19 : The impact on the semiconductor industry

- SG Live

- 2020-05-29

Covid-19

: The impact on the semiconductor industry

[ Impact of covid-19 on semi-market ]

As the number of cases from Covid-19 has rapidly increased globally, we are seeing tremendous effects on all markets. The semiconductor market was already being affected in 2019 by geopolitical issues, but is now facing challenging times due to additional supply chain disruptions.

1)Overall market situation

We are continuing to see the effects of Covid-19 on the semi-market and the disruption to our supply chains. We are also seeing large fluctuations of both supply and demand due to the build-up of inventory in some cases and increased demand in others.

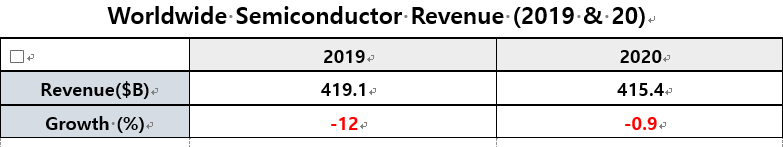

According to the data from Gartner, Inc, worldwide semiconductor revenue will decrease just 0.9%(Revenue: $419.1B -> 415.4) in 2020. In 2019, the semiconductor market was already headed for a downturn. (Growth rate in 2019: -12.0%.)

Many people are expecting there to be large disruptions in the market as we are seeing in some other industries. However, so far, we cannot find substantial reduction in the semiconductor area. We believe a build-up of inventory and needed devices for safety products may be driving this.

Even the revenue of non-memory (Automotive / Consumer electronics / Smart phone+ 5G communication / ETC) is expected to decrease 6.1%,

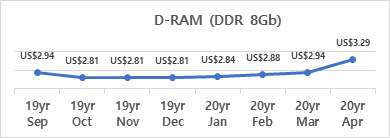

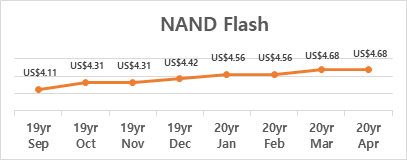

but memory market is forecast to grow 13.9%. As the investment for data centers and communication infrastructure is increasing, the demand for memory products is getting larger. In response to the increased demand memory prices are also getting higher.

Memory Price Change (D-RAM/ NAND-Flash)

*D-Ram price : $2.94/units in 20.04.xx -> $3.29/units (has skyrocketed 11.9 %)

*NAND Flash price: $4.11/units in 19.09 ->$4.68/units

2) Logistics

SEMI sent out a survey to SEMI member about the impact of Covid-19 in February and March. The percentage of YES for the question "Has Covid-19 impacted shipments?" was 45% in Feb, but it increased to 55% in the March.

In February, the virus did not seem as serious as it is now. Since March, the virus has started spreading dramatically all over the world.

As the situation in China was getting better, Europe and the USA were struck by the outbreak of Covid-19. Now, almost all countries are enforcing nationwide lockdowns. Experts saying that it will lead to delays in shipping and affect the supply chain in the Semi market (Delivery issue of materials/Equipment).

3) Fab Utilization

The semiconductor industry appears to have escaped the direct impact of the Covid-19 crisis so far, some fabs are running at max capacity and most of the fabs are continuing high level of utilization during this pandemic situation. Semiconductor fabs are inherently clean and highly automated, yielding an environment that’s not conducive to the spread of disease. As a result, foundries operating in countries including SMIC, TSMC and UMC have been able to maintain normal production conditions without many changes.

According to the TSMC Revenue report, the revenue of March 2020 was about NT$113.52 billion, an increase of 21.5% from February of 2020 and an increase of 42.4%. Moreover, the revenue for January through March was NT$316.60 billion (42% increasing, compared to the same period in 2019).

Also, the revenue of UMC increased in the same period (28.35% increasing, compared to in 2019). Currently, UMC and TSMC keep having a stable utilization rate.

Overall production of the two biggest memory chip suppliers, Samsung and SK hynix (DRAM and NAND flash), is likely to remain unaffected by the deadly virus in the short term. Experts expected mobile-phone and PC industries to weaken due to delays or halts at manufacturing sites, however, this is likely to be offset by solid demand from server manufacturers as data centers in North America and China continue to expand, led by increasing over-the-top services, games and on-line activities. Inventory restocking at data centers in anticipation of potential DRAM shortages in 2H20 will also contributes to strong memory chip demand as well.

Furthermore, Fabs in china SMIC, CSMC and other memory fabs such as YMCT/CXMT seem to be not be affected much by Covid-19 as well.In the early stage of the Covid-19 outbreak, there was a decrease in utilization rate due to labor shortages (the fabs are located in the out of cities) and travel restrictions by the government. But after the recovery signal, the utilization rate stabilized and returned to previous normal rates. Of course, it is obvious that the overall utilization rate for 2020 will be below last year due to the serious virus situation in the early part of this year.

In the case of TI(Texas instrument), even though they have been suffered from a decrease of sales volume after the Covid-19 outbreak, they are cautiously optimistic. They officially announced that they will keep current utilization rates to respond to the uncertain market situation and they have announced plans to continue their $850M construction investment in Richardson, Texas.

4)Semiconductor Equipment

SEMI says that compared to 2019, It is expected that only Korean ($10Bilion->$12Bilion) and European ($2Bilion->$3Bilion) fab equipment spending will increase in 2020. Other areas will decrease.

Due to the uncertainty of the semi-market situation, it is expected that IDMs will delay planned hardware upgrades and other long-term projects. Depending on the recovery situation (U vs. V), IDMs will need to be adaptable and modify their strategy. It will be harder for OEMs to have the flexibility and respond to quickly to changes in End-user demand. It seems that most of the equipment manufacturers (OEM) are unaffected by the Covid-19 virus in the short term. They are carefully assessing the continuous challenges and If this situation continues for an extended period, they will suffer from the supply chain disruption and possible delays and lead time issues. Especially, one of the biggest issues for the OEM is travel restriction. In order to meet the customer’s investment schedule, they must dispatch the engineers for installations as scheduled. However, all the governments are imposing travel restrictions and 14 days of quarantine prior to coming on site. It is getting tougher for OEMs to keep to schedules and support their customers immediately.

*ASML is already having some delay issue of EUV equipment to Samsung because of the virus situation.

[ Conclusion ]

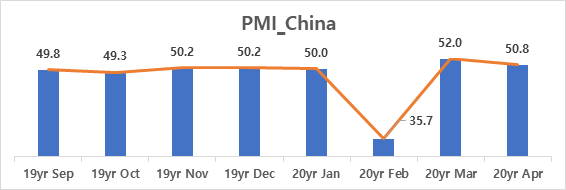

I believe that the worst is yet to come. Currently the fab utilization is stable and china fabs are also getting back to normal. Moreover, the PMI is getting higher. (China PMI was decreased to 36.7 in Feb, but back to normal in March.)

Of course, this is such a bright signal in overcoming the Covid-19 situation, but there is still a risk of recurrence. The Korean government has controlled the virus situation quite well, and now many countries are following Korea’s Covid-19 strategy. The number of daily confirmed cases were over 300 during March but has now decreased to almost 0(Domestic infected) in April. However, we should not let our guard down as the spread of Covid-19 can re-occur anytime when we think it is all over.

To be honest, no one knows when the virus situation will finally be over. Maybe, there is no such ‘Ending’ for this sad story. We should prepare for the long-term impacts for Covid-19. For the company, business continuity planning will be the most essential. At the personal level, we should be more careful about personal hygiene and follow the government guidance accordingly in order to avoid the Covid-19.

Facebook

Facebook Linkedin

Linkedin WeChat

WeChat YouTube

YouTube Instagram

Instagram Sitemap

Sitemap